Screen Businesses In Minutes, Keep Track Of Them Forever

One place where risk teams screen and monitor, from adverse media to sanctions.

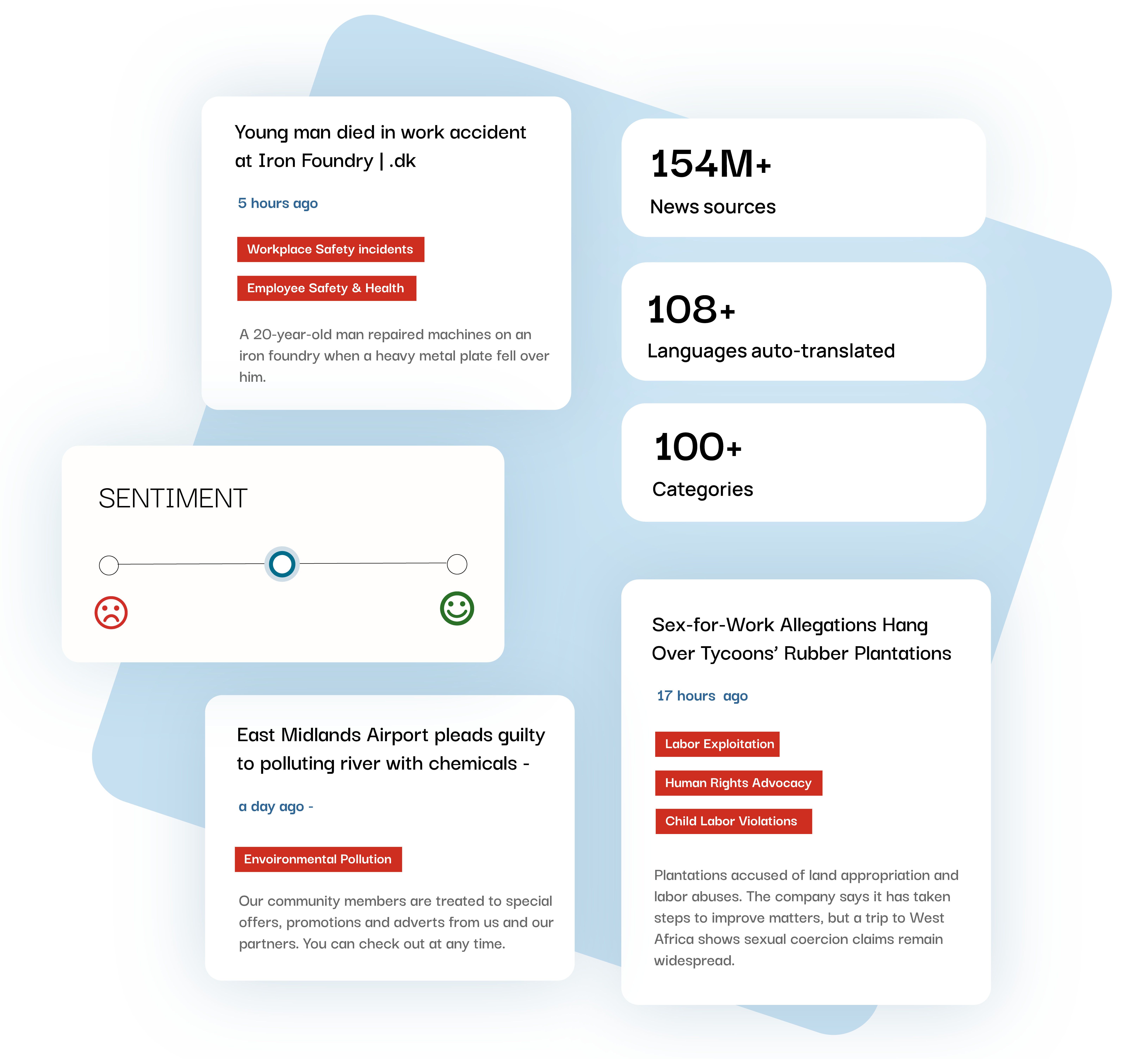

Access the largest adverse media database and gain insights to what matters to your objectives.

Trusted by leading organisations around the globe

Auditors using Business Radar have reported a 32 percent average increase in efficiency during periodic reviews and screenings, compared to traditional software.

Verify and monitor third-party risks so they cannot become your problem

Business Radar continuously screens global news and public data sources to flag adverse media, ESG violations, legal exposure, and supplier instability. Being on par with all developments means that your team can act faster and with confidence. With Business Radar, you are

Spotting reputational, ESG, and Compliance Risks.

Automating checks to stay updated with minimal effort.

Using the latest technology including GPT-generated summaries.

Fully global, with content translated into more than 100 langauges.

Fully GDPR compliant and ISO Certified. Hosted in the European Union.

One Platform, Multiple Screening Layers

Business Radar aggregates data from 1,200+ sanctions and enforcement lists, politically exposed person (PEP) registries, and diverse adverse media signals in over 108 languages. Whether you’re

- onboarding a vendor,

- verifying high-risk clients, or

- auditing your supplier network,

our platform adapts to your risk criteria and scales with your business.

Your Global Lens on Risk

From regulatory hotspots to remote jurisdictions, Business Radar gives you worldwide visibility into third-party risk. Screen vendors in Vietnam, investors in Nigeria, or subsidiaries in Brazil with confidence thanks to logal and global coverage.

You can’t monitor what you can’t see. With Business Radar, you’ll have a worldwide view in one tool.

Say goodbye to manual searches and endless spreadsheets. Business Radar scales with you and ensures you can focus on what really matters.

Manual screening is slow, error-prone, and can be blind to emerging developments. Business Radar replaces static checks with dynamic, ongoing monitoring so you never miss an update.

“Automated news save me a lot of time while delivering more quality, improving my productivity and help me be well informed for client meetings.”

Partner, Audit & Assurance

“I am happy, the news are mostly relevant, and I like how I can sort them and organise based on my preferences.”

Consultant

“I am a big fan and happy we are now all up-to-speed with our clients’ developments.”

Manager, Risk Advisory

Business Radar’s Adverse Media Monitoring

- 1.5 Million news sources screened every day.

- Receive alerts filtered by more than 200 categories.

- Receive pro-active alerts instead of conducting reactive searches.

- Create & update portfolios within minutes, not hours.

Due Diligence Made Easy

- Screen against more than 1,200 sanctions & enforcement lists

- Access Corporate Structures and unfold hidden subsidiaries

- Check if entities are listed on Offshore-Leaks databases.

- Be compliant with full audit trails.

Get in touch with us now and see for yourself in a live demo followed by a free 1-week trial account. Sounds great? Lets meet!

Start screening smarter, faster, and more proactively.

Trusted By